By Piero Russo & Oleksiy Danilin, BSRIA.

By Piero Russo & Oleksiy Danilin, BSRIA.

In this series of reports, we highlight key findings of our European Smart Home Market Study which was carried out during 2011 with a view to anticipating how the market will develop over the coming years. We undertook the research by interviewing and exchanging information with the top players and stakeholders around Europe, and the resultant study is the one of the first to comprehensively analyse all of the available knowledge on smart home technologies and generate reliable market data. The project includes nine in-depth reports on different European markets: Germany, France, UK, Netherlands, Belgium, Norway, Sweden, Denmark, and Poland. In this issue, we summarise the results from the UK.

Smart Home Market in the UK

The smart home market in the UK has grown regardless of the economic recession, driven by inelastic demand on high-end solutions, the growing demand for residential smart home solutions in commercial buildings and, to some extent, the sales increase in the mid-range segment. According to BSRIA estimates, in 2010 the market reached GBP 26 million (EUR 30 million) value, 12% higher than in 2009. Over 53% of the value was generated on the system integration side.

The UK smart home market is highly concentrated in the luxury segment where over 70% of the market value is generated. Out of some 10,500 smart homes in the UK, no less than 70% are concentrated in Greater London and neighbouring counties. Over 60% of the revenues come from installations, upgrades, and remodelling in the existing housing stock.

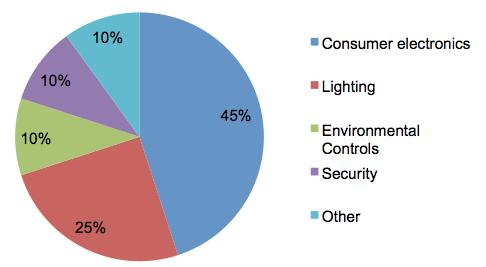

While the share of new housing is increasing, over 60% of smart home revenues are still generated in the existing housing stock. Indeed, a substantial share of smart home revenues in the existing housing stock is from upgrades and remodelling, and most smart home installations still deal with high-end AV and lighting systems (45% and 25% respectively).

Challenges

Apart from the ‘advanced’ DIY segment, customer knowledge of home automation technology in the UK is limited. It is still rather difficult for an average consumer to have a grasp of all of the technological aspects of smart home solutions. Many manufacturers, such as Crestron and Control4, provide training for their installers/distributors but do not go further down in the end-consumer segment.

On the manufacturers’ side, the competition has substantially intensified in the last few years, with the major pressure from Continental European companies. Some manufacturers, such as AMX, are gradually exiting the residential market. The competition in the fragmented system integration segment is even tougher. Most of system integrators are localised, limited in resources, and able to secure 3-4 installation jobs a year on average.

Home Energy Management System Market (HEMS)

Although the UK HEMS market is referred to as the most advanced in Europe, it is still very small, amounting to only EUR 8 million in 2010. However, between 2008 and 2010 the market value was boosted seven-fold as a result of energy saving initiatives by the six top British utilities.

The market could be significantly driven by smart meter roll out. It is expected that by 2020 all 27 million British households will be covered by 48 million electricity and gas smart meters. By 2013 the smart meter and energy display penetration in the residential sector will have reached 12% of total households.

It is estimated that up to 900,000 British households have intelligent controls installed, i.e. less than 3% of the total. In the UK, there are no legislative requirements as to the installation of specific heating controls, which hinders the promotion of ‘intelligent’ products in the new housing segment.

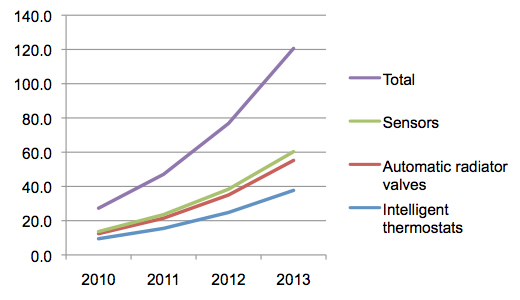

In the medium term, the value of intelligent environmental controls market is set to grow at quite a high rate due to the overall market immaturity. The segment of automatic radiator valves is expected to be the fastest growing among the three segments considered. However, intelligent (programmable) thermostats will remain the predominant product of the range.

KNX in the UK

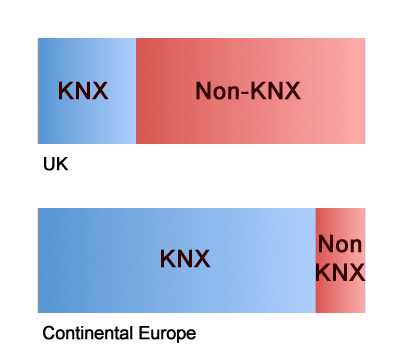

The share of KNX-based products in UK market in 2010 stood at only 30% compared to 80-90% in Continental Europe, however the share of KNX manufacturers increased from zero to 30% within only three years. The share of ‘continental’ KNX-based manufacturers in the UK is constantly increasing. In 2010 they amounted to roughly 30% of the market, with ABB, Theben, Siemens, and Schneider Electric accounting for two-thirds of the total KNX share.

It is expected that the smart home system market will have increased by 30% between 2010 and 2013, but the market will demonstrate a significant decrease in average job size due to the shift from the luxury segment to mid-range solutions. The share of KNX-based products will increase to 60% of the total.

Outlook

After luxury houses and apartments, the second largest segment is commercial buildings, accounting for 18% of the total market value. Residential smart home solutions are mostly allocated in hotels, cafes, restaurants, and conference rooms. This ‘migration’ into the commercial sector is set to compensate for the limited demand in the residential sector.

Although they still bring high value, the potential of high-end AV and lighting systems is rather limited in the medium term. In 2010, intelligent environmental controls was still a very small market of EUR 13.6 million. It was primarily confined to medium- to high-end households that require a greater degree of temperature control. Market development is hindered by conservatism of consumers, installers, and lack of legislative requirements on room temperature control, however, the market value is set to quadruple, mostly in connection with residential heating systems modernisation.

There are also opportunities in the small business segment, and assisted homes for seniors – which should be addressed with appropriately adjusted solutions.

Conclusion

The lion’s share of installations takes place in the existing housing stock and is driven by the demands of upper-income households and DIY customers. The market is hardly driven by energy efficiency reasons.

To overcome growth constraints, the product market should expand from the high-end into the mid-range segment, where smart home products must be financially affordable and easy to use.

To provide a ‘mass-market’ off-the shelf solution, the industry should ensure the use of universally applicable devices (such as the smart phone and tablet) as user interfaces, and establish a universal standard of communication such as the KNX protocol (the most appropriate option currently available), as well as looking at technological opportunities for integrating consumer electronics, security, and lighting on the one hand, and heating and home energy management systems on the other.

Piero Russo is a Senior Market Research Consultant, and Oleksiy Danilin is an International Research Consultant for BSRIA, a specialist consultancy that offers worldwide market intelligence across a broad range of building infrastructure products and services.